No one will ever own a computer in their home.

No one will ever put a phone in their car.

No one will ever need Microsoft Word on their phone.

No one will ever pay for things using their phone.

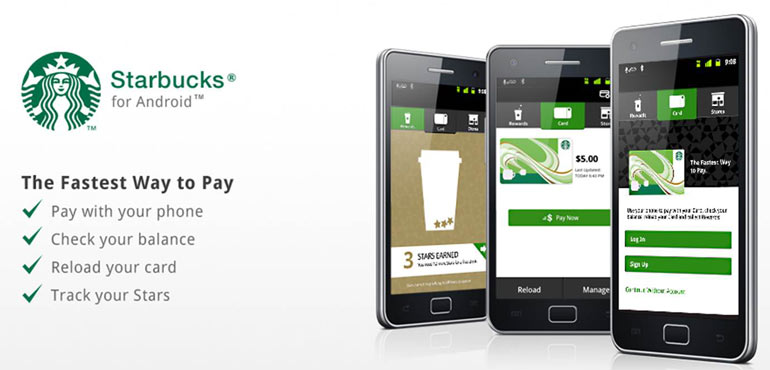

All of those statements have been proven wrong by technology. The last one–proven wrong both by technology and by America’s favorite coffee shop, Starbucks.

Through their mobile app and their easy to use pay-at-counter system, Starbucks is now reporting that 1 in 10 purchases is paid for by mobile app, the company’s Chief Digital Officer Adam Brotman reported during their earnings call on Friday. In addition to the growth of paying by mobile, loyalty cards were up 30% year over year, which is also tied into their mobile app.

This is great news for startups like Dwolla, Boosterville, Paytango and the countless others that are relying on people moving from physical wallet to digital wallet.

Starbucks is leading the way in terms of mobile payments at huge retail chains, but Paypal is actually breaking into the mainstream as well. Paypal account holders can now integrate their Paypal Mobile app with a phone pin (set up in app) and pay for their purchases at the checkout at places like Home Depot, Champs, Babies R Us, Dollar General and several other retail establishments.

Some entrepreneurs, like Boosterville CEO and co-founder Pam Cooper, are integrating mobile services a la Starbucks. With the Boosterville app, mobile wallet and loyalty & rewards are being integrated for fundraising.

While mobile payments are on the rise, startups like PayTango are taking it to another level with biometric wallets. Services like PayTango, which is currently beta testing in Pittsburgh and California, allow users to pay for things using their finger print. At CES earlier this year we met with a startup that is hoping to use retina scanning technology for payments as well.

Sometimes all it takes is one big name (Starbucks) to adopt a technology. Before too long, even grandma will think it’s normal to pay from her phone.