Stay on Track With Indinero

Stay on Track With Indinero

“The most important financial metric for most startups is monthly cash flow. Indinero lets us easily see how much we’re spending each month by category so we can budget for the coming months.”

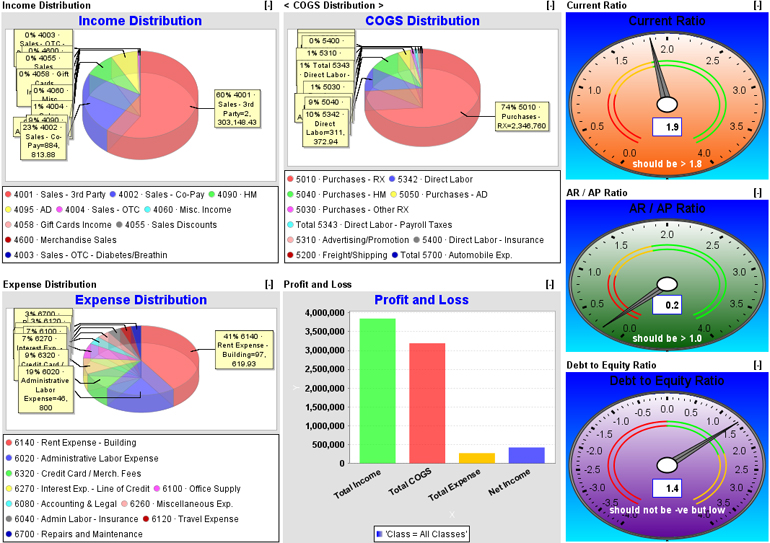

QuickBooks Eases Things

“Almost all small business accountants in the United States are familiar with QuickBooks. Thus, I recommend any QuickBooks product (although I like Online Edition the best) because it makes it easy for your to clean up books and collaborate with your accountant for tax time.”

Outright Shows Everything

“I’ve got Outright set up to push notifications to my phone: every time I receive a payment, my phone goes ‘cha-ching!’ It’s a good noise to hear. On top of that feature, Outright can automatically pull in data from accounts and other apps, while putting everything together in a format that makes my CPA very happy. (Disclaimer: I write for the Outright blog, as well as using the app religiously.)”

Go With Google Docs

“Google Docs is a great tool to manage business finances. It’s very powerful and simple to use which makes it a breeze to use.”

Pay Up With Square

“Square is a great payment processing mobile app that makes accepting credit cards a snap and moves money quickly into my bank account.”

Microsoft Excel Is Still Relevant!

“It is the industry standard for spreadsheets for a reason. With a little training, you can run circles around any closed source software.”

I Owe It All to Freshbooks

“I’ve never been very good with money. In fact, at one point, I appeared on CNN as the poster child for those with shopping problems. But Freshbooks helps me keep it all together on the business side. I use it to track my time and my business expenses, send invoices (and followups), send out and receive estimates, and generate tax reports. And despite my history with money, it’s all a breeze.”

Wave Accounting Saves Time

“Wave Accounting is completely free and connects directly to your bank account. It automatically keeps track of all your spending for you. It’s a great product and a huge timesaver.”

Sync With Mint.com

“Although most people use Mint.com to monitor their personal finances, many business owners don’t take advantage of doing the same thing with their business accounts. Not surprisingly, Mint’s software works similarly with business bank accounts and credit cards, which makes it very valuable to manage budgets and overall spending.”

Stick With Shoeboxed

“I used to dread tax time, because my receipts were always a mess, and often nonexistent. Shoeboxed makes it incredibly easy to keep track of all of my receipts, and then import all of the data to sites like Outright, Mint, etc.”

There Are Still ‘Human’ Applications…

“I have this awesome human application called a Director of Operations. She handles all the accounting, financing, taxation, and regulation. It’s like magic. I’d highly recommend getting one. They can read between the lines on all those long-winded documents and keep you from wandering into trouble.”

The Young Entrepreneur Council (YEC) is an invite-only organization comprised of the world’s most promising young entrepreneurs. In partnership with Citi, the YEC recently launched #StartupLab, a free virtual mentorship program that helps millions of entrepreneurs start and grow businesses via live video chats, an expert content library and email lessons.

businesses more comfortable and easier to run. But as a young startup, you have no such luxury! Because it’s important to make every dollar count while your business

businesses more comfortable and easier to run. But as a young startup, you have no such luxury! Because it’s important to make every dollar count while your business