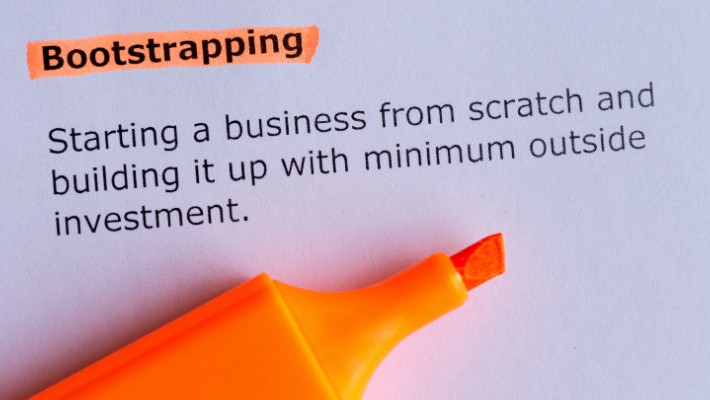

If you would like to make sure that you are not overspending when starting your entrepreneurial journey, it is important that you create a list of all the necessary costs and equipment you will need to start your operation. Without completing this step, you cannot create financial predictions or even a business plan, which is needed in case you would like to apply for business financing options. Below you will find a few tips on creating your startup budget.

Registration and Trademark Costs

If you are starting a new brand, it is important that you get your logo and designs registered with the patent office. Failing to conduct a company name check can result in legal trouble, and even the closure of your business. Before you choose your trading name, research it and get a quote on logo design, website development, and other brand-related services that will help you establish your business on the market.

Cost of Premises

Next, you will have to calculate the cost of your business offices. Even if you start working from home, you will probably have to invest in faster internet and a more powerful computer. Depending on what your company will be doing, you might need to get business insurance. If you have to rent an office or workshop space, make sure that you list every expense, including insurance, deposit, and other registration costs.

Essential Services

Every business needs some services for smooth operation. First, you will need internet service that is reliable. You will also need a phone line or a couple of cell phones. If you have to deliver goods, you might need to sign up for a contract with a delivery company, and this will cost you a monthly fee. Becoming a member of a local trade or industry organization will also come at a cost. If you would like to create a buzz about your company, you might even join a local networking group for an annual fee.

Tools and Materials

Apart from regular and fixed expenses, you will also have one-off starting costs. If you are planning to manufacture unique accessories or furniture, you will need to invest in professional tools. Check out monumenttools.co.za to get an idea on the prices and estimate the cost of all your manufacturing tools, materials, and safety equipment. It is important that your business has everything it needs to start generating profits from day one.

Employee Costs and Tax

Every successful startup takes employee training seriously. If you would like to get the best people to work for you, it is important that you offer a competitive salary and great benefits. Calculate the cost of training, education, checks, tax, payroll system, and perks when creating your detailed business plan and estimating your costs and profits.

To make sure that you are aware of the cost of starting your own business, you should make sure that you list every startup cost and budget carefully, so you have a realistic view on your future profitability and return on investments.