We talk about Shark Tank on ABC here on nibletz.com quite a bit. That’s partly because it’s a great show about startups and partly because no matter what we’ve reported it’s still my favorite show.

We talk about Shark Tank on ABC here on nibletz.com quite a bit. That’s partly because it’s a great show about startups and partly because no matter what we’ve reported it’s still my favorite show.

In fact, Daymond John and Mark Cuban have done some great things for entrepreneurs, startups, and even students interested in startups and entrepreneurship. Both Cuban and John speak regularly at entrepreneurship conferences and colleges. John even held a Google+ hangout for high school students studying business.

We recently obtained the application for your business to appear on the Shark Tank. It’s not a top secret application or anything like that. Just about any entrepreneur interested in Shark Tank’s open casting calls can obtain the same application.

We highly advise, that if you’re planning on pitching your startup to Shark Tank in their open casting call, and especially if you make it past that point that you read the fine print.

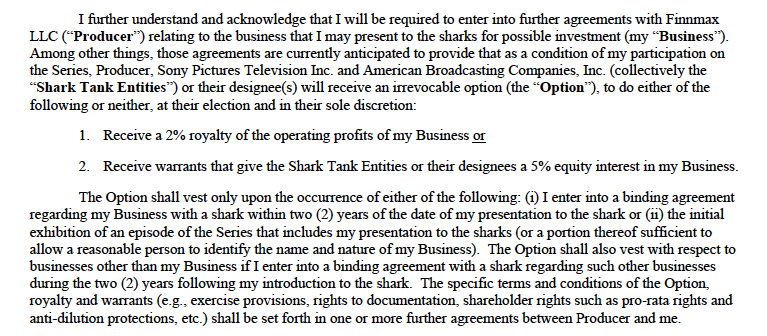

As the headline states, Shark Tank producer’s Finnmax, Sony Pictures Television, and the American Broadcasting Company (ABC), have some very interesting rights, if you chose to appear on the show.

First off they have an option to receive a 2% royalty of the operating profits of any business that actually appears on the show itself, regardless of whether the sharks invest.

If they decide not to take the 2% royalty they have the option to instead take a 5% equity interest in the business.

Now keep in mind this 5% equity investment isn’t in exchange for any funding at all and isn’t contingent on the startup getting funding from one of the sharks. This is just for appearing on the show itself.

That section of the application does go onto say that the “Shark Tank Entities” will give good faith consideration as to which of the two options the business owner/entrepreneur wants them to have, be it the 2% royalty or 5% equity, however it’s at the sole discretion of the “entities” and the irrevocable option is available for two years.

Shark Tank is currently on break but will return for a fourth season and I will watch every episode as I’ve done on the previous three seasons. But now we all know a little more about the show.

Linkage

Read this story about when a Shark Tank startup gets reneged on

See more of our Shark Tank stories here