The national VC investors and angels who spoke at Everywhere Else Cincinnati loved the concept of talking to and educating entrepreneurs from everywhere else. In the months leading up to Everywhere Else Cincinnati, we fielded a lot of emails from investors asking about pitch contests and deal flow. Joe Medved joined Blair Garrou (Mercury Fund), Mark Hasebroock (Dundee Venture Capital), Mark Richey (West Capital Advisors/Draper), and Bob Coy (Cincy Tech) on the stage at one point or another during the conference to help educate early stage startups and entrepreneurs. The general consensus was if entrepreneurs are more in tune with the investor community, a lot of time will be saved.

Medved took that idea to the extreme by cramming down probably an entire college course worth of entrepreneurial content into a 30 minute talk and equally robust slides.

Our Managing Editor Monica Selby already covered the truth about getting VC attention, almost immediately after Medved left the stage.

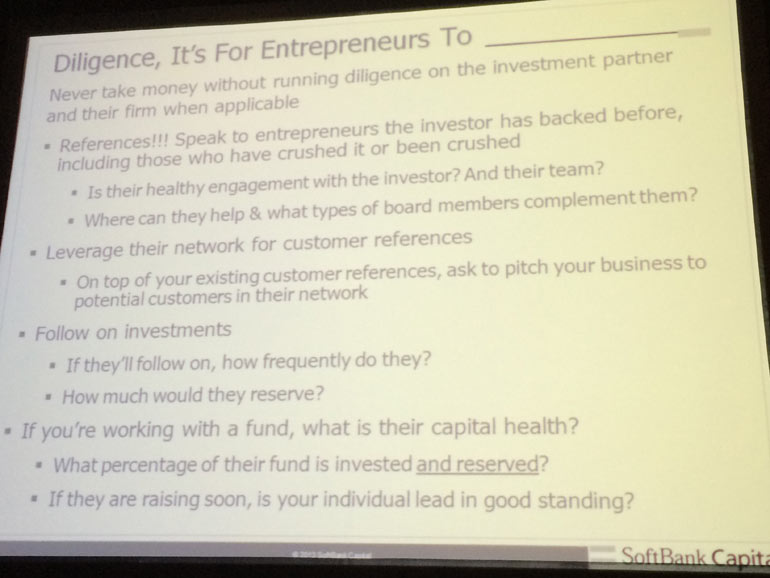

Medved’s presentation was filled with important information. Equally as important as getting VC attention is the fact that due diligence is just as important for the startup as it is for the investor. Too many times startups are so excited about getting a “yes,” they are willing to take money from anyone.

Entrepreneurs need to make sure that the investor is the right fit for their startup. Does the startup see eye to eye with the investor? Does the investor bring value to the startup outside of just money? Taking on an investor is a partnership almost like a marriage. Just as a marriage, it may take a while to get into but it’s a lot harder to get out of. In that respect it’s even harder to get an investor out than it is to get divorced.

Medved offers these tips for doing due diligence on your investors:

- References! Speak to entrepreneurs the investor has backed before, including those who have crushed it and been crushed.

– Is there healthy engagement with the investor? And their team?

– Where can they help & what types of board members complement them? - Leverage their network for customer references

– On top of your existing customer references, ask to pitch your business to potential customers in their network - Follow on investments

– If they’ll follow, how frequently do they?

– How much would they reserve? - If you’re working with a fund what is their capital health

– What percentage of their fund is invested and reserved

– If they’re raising soon, is your individual lead in good standing?

All of these points are very important to a startup. As painful as it may be for your pocketbook or bank account or even your startup, if the answers to these questions aren’t comfortable for your team, product and startup you may need to look for another investor.

Follow Joe Medved on Twitter @joevc