In a previous piece, I discussed what early stage entrepreneurs needed to know in order to secure angel investment attention in 2014. For the fortunate few who were successful in landing a coveted “yes” to taking an actual meeting, there is usually little time left to prepare for the most important part of the funding process – the investor presentation. This is the first true opportunity for startups to provide an in-depth narrative and discuss financial expectations with an interested investor.

Fortunately, many entrepreneurs have already gone down this path and know that balancing the everyday role of running a startup and finding the time to prepare for investor meetings doesn’t have to be a constant struggle. Consider the four following ways to make sure you don’t lose investor attention now that you’ve got it and enter the negotiating room as prepared as possible.

Have a Command of the Facts

Have a Command of the Facts

Now that you’ve managed to spark the interest of an investor after what was probably a brief initial encounter, preparing for the subsequent in-depth meeting is a much more intense experience. You must be prepared to speak in depth to every aspect of your venture—management’s experience, go-to-market strategies, competitive landscape, etc. Don’t guess; when asked a question to which you don’t know the answer, it’s better to acknowledge the quality of the question and tell the prospective investor that you would like further time to consider the question and that you will provide your answer in a follow-up email or phone call. Furthermore, don’t be defensive, because you will come off as someone with whom it would be difficult for the angel investor to work. Instead, recognize the questions for what they are; namely, not objections to you, your thinking, or the venture, but simply probes to learn

whether your venture meets the individual’s or group’s investment criteria.

Don’t shy away from your failures

It might seem like discussing past failures of the founder or its management team would reflect poorly on the startup and therefore should be avoided, but that is actually the opposite of what is likely to impress a potential investor. Instead, be prepared to discuss previous failures and what was learned from them; an experienced investor will have done his/her homework and know about them anyway so be upfront and use it to your advantage.

What kept you up night after night asking questions and vowing never to do again? How have your failures shaped your strategies for your current venture? An investor wants to be certain that if a financial relationship does result from the meeting, the founder and team are prepared to receive constructive criticism and learn from past mistakes. The ability to navigate uncomfortable situations and withstand scrutiny from an investor or group of investors demonstrates the startup’s capacity to handle the inevitable pressures that will result from running the business.

Be realistic about the money

It’s easy to “spend” another person’s money. Don’t fall into the trap of thinking that the amount you are looking for is a pittance to the investor because of his/her wealth. Investors worked hard for their financial comfort, and they are likely to guard it preciously. The investors with whom you will be speaking have allocated a certain amount of their wealth to early stage investments, but from among the investment opportunities within that asset class they’ll favor the ventures that, all other factors being equal, offer the largest potential reward for the least amount of risk.

That means that you must establish a realistic and defensible pre-money valuation (“PMV”) or current value for your venture. Set it unrealistically high, and the investor is likely to screen you out both because the PMV would not yield the investor enough ownership to meet his/her return expectations and because by doing so you’ll have shined a bright light on your inexperience, unreasonableness, or arrogance.

Setting your PMV is an essential exercise in searching for equity investment. Do your research— what value have other companies in your space and geographic region recently sustained in their financings? Early stage venture attorneys in your area may be able to help you answer this question. There are also online tools like Worthworm to assist you with this exercise. Avail yourself of all of the tools and information available to you to set your value, because even like the best public stock, your investment opportunity will only be attractive at the “right” price.

Have clear go-to market and growth strategies

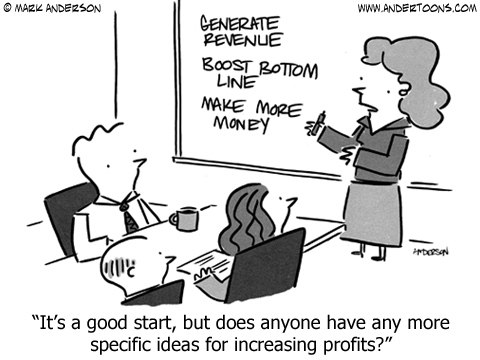

An investor is going to want to understand in very real and clear terms how you plan to reach your target audience and how that will scale over time. Be prepared to discuss revenue plans and business models, and to defend your decision for each. Create a narrative that proves why your venture is worth the current asking price and how that worth will continue to grow at an attractive pace.

The true tests of the validity of your strategies lies in customer acceptance and growth in your venture’s value. With respect to the former, do all that you can to show early sales, i.e., customer validation, and be prepared to discuss what you’ve learned from these customers. With respect to the latter, recognize that as an entrepreneur among your highest responsibilities is to implement strategies that will grow the value of your company, and by extension the value of an investor’s ownership in your company, to its highest points at the quickest pace. Ensure that you can articulate how you intend to build the company’s value quickly and consistently toward an exit event that will yield your investors their target rates of return.

Leading a startup team is a risky move. Thousands upon thousands of startups are seeking startup capital from a relatively limited number of investors. If a great idea does spark the interest of a potential investor, use the investor presentation as an opportunity not to extoll how great your idea is, but how prepared you and your team are to execute the idea and grow it into a highly valuable business.

Alan Lobock is the co-founder of Worthworm (www.worthworm.com) and SkyMall. Having been on both sides of the start-up investment scene– seeking investment for his ventures and as an angel investor himself, Alan launched Worthworm to solve one of the biggest challenges young companies and their prospective investors face—how to compute a credible and defensible PMV for an early stage venture seeking angel investment.