Download | Subscribe

Gary Swart is the CEO of oDesk, the world’s largest online workplace—which has more than 4 million freelancers, and on which more than $1 billion of work has been done. Gary is a thought leader in entrepreneurship; how best to hire and manage teams; and the future of work, including online work. He is passionate about helping small businesses thrive, fueled by his extensive experience working with startups and small businesses that use oDesk, as well as by mentoring entrepreneurs and business school students. Gary has spoken at the Inc. Leadership Conference, The Economist’s Ideas Economy panel, South by Southwest, TechCrunch 50, TiECon, GigaOM’s Net:Work Conference in 2010 and 2011, and at Harvard Business School which teaches a case study on oDesk. His commentary has appeared in a variety of publications including Forbes, TechCrunch and The Washington Post. He has also appeared on numerous TV and radio shows, including BBC, National Public Radio, and the Fox Business program “After the Bell.” Previously, he led SMB Sales for the Americas at IBM’s Rational Software Product Group, and also served as VP of Worldwide Sales at Intellibank, where he was responsible for leading the sales organization.

Paul Singh’s Disruption Corporation Solves the Series A Crunch With Data

So much has been written about the Series A crunch. Lower costs of starting up, more streamlined avenues for disruption, and a general sense of optimism about the future of startups has led to increased funding in the early stages of a company. For better or worse, the trend has created more than a few startup orphans between the seed round and Series A.

“There’s a funding gap between the Seed round and the Series A — and it seems to be getting wider,” he wrote in a blog post yesterday. “Rather than writing it off as the “Series A Crunch,” I believe the investors that can systematically identify the most promising companies are positioned for great returns.”

As a partner at 500 Startups, Singh knows first hand about making tons of seed round deals. But he saw opportunity between the seed round and the Series A. Not every company is ready for a full Series A when they run out of money, but that doesn’t mean they’re doomed to failure yet.

Singh left 500 Startups in the spring of last year and launched Dashboard.io, which spawned Indicate.io. The data product tracks “indicators” for different companies to give entrepreneurs and investors an idea of how those companies are performing.

Evolving into a fund seemed like the natural next step for Singh. He believes the market is now less about “deal sourcing” and more about “deal selection,” but how do you pick the winners when there’s so much noise around startups these days?

“We’re going to use our own data, tools and research to make fewer wrong decisions about the companies we’re considering for investment,” he said.

VC investing used to be about trusting your instincts and knowing a good deal when you see it. But, with the explosion of data products–including the one created by Singh’s Disruption Corporation–it seems it’s time for VC to catch up with the rest of us.

The Crystal Tech Fund will focus on that sweet spot between the $50k seed round and the $5 million Series A. They’re looking to select companies that have achieved some level of product-market fit, and revenue would make the deal that much sweeter.

Find out more about the Crystal Tech Fund here.

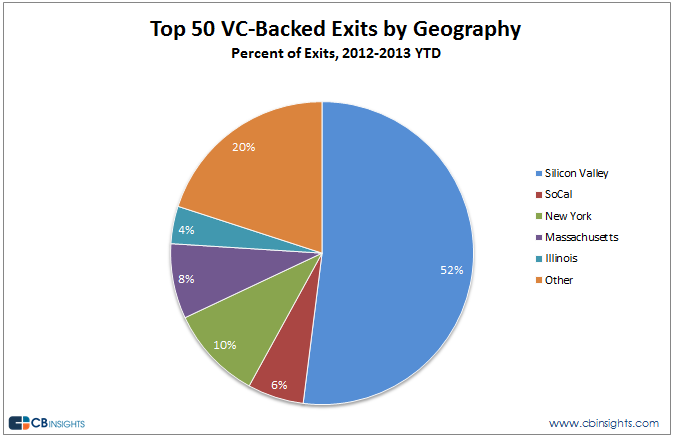

CB Insights: Silicon Valley Is The Only Relevant Market For Venture Capital

Top research firm CB Insights released some very relevant and interesting data last week. The firm has been diving into their VC data to better understand fund performance and syndicate. In what they call one of their “more polarizing” briefs, they revealed that even today Silicon Valley is the most relevant market for venture capital. Silicon Valley is still producing the most exits.

Top research firm CB Insights released some very relevant and interesting data last week. The firm has been diving into their VC data to better understand fund performance and syndicate. In what they call one of their “more polarizing” briefs, they revealed that even today Silicon Valley is the most relevant market for venture capital. Silicon Valley is still producing the most exits.

Their latest data, measuring deal flow across the country, Silicon Valley still represents 52% of VC backed exits, leaving “everywhere else” with an improved, but still less, 48%.

When purely looking at the value of exits, Silicon Valley is still far ahead of everywhere else. When CB Insights analyzed the valuation of the top 50 exits in the country Silicon Valley companies accounted for 86% to the top aggregate exit valuations of those top 50 exits. In 2012 Facebook’s IPO accounted for a tremendous chunk of the 86% but once removed Silicon Valley still accounts for 54% of the aggregate exit valuations.

New York, Southern California, Massachusetts and Illinois trail behind Silicon Valley.

There are even investors who believe that New York is a waste of time.

CB Insights reports that at a recent dinner in NY hosted by Silicon Valley firm Lowenstein Sandler one VC said “New York is an irrelevant market for us as a venture capital firm. They went on to say that from the investor’s perspective allocating his firm,s time to New York or any other market outside of Silicon Valley was a waste of time.

But there’s hope.

Late last month AOL founder Steve Case announced that his Revolution Venture Fund had raised $200 million dollars that they were specifically going to use to back companies everywhere else. Case’s big mantra is “Rise of the rest,” and that is exactly what’s going on now.

There have always been investors and startups everywhere else. One of the fundamental problems we’ve found since launching Nibletz and the Everywhere Else conferences is that entrepreneurs and investors exist everywhere. The problem lies in the fact that the entrepreneurs believe that it’s best to move to Silicon Valley or in some regards New York City to grow their company. At the same time the investors either don’t know that there are good deals in their own neighborhoods or it’s just flashier to find an investment in a larger city or participate in rounds with Silicon Valley.

Investors like Mercury Fund’s Blair Garrou, Dundee Venture Capital’s Mark Hasebroock, and Drive Capital’s Mark Kvamme all see the value in finding startups worth investing in everywhere else, thus contributing to the rise of the rest. These investors are not alone. At our recent Everywhere Else Cincinnati conference, we had over 40 investors from across the country that represented over $1 billion dollars in deals across Everywhere Else. (Note we still consider New York Everywhere Else and obviously many others do too.)

Events like Big Omaha, Big KC, UpGlobal’s startup summit, and the Everywhere Else Conference Series all unite entrepreneurs from everywhere else to continue developing their own market.

The notion that innovation only happens in Silicon Valley is quite ridiculous. Cars were invented in Detroit. Air planes were invented in North Carolina (some may dispute that). The overnight package was invented in Memphis, Tennessee. In the overall landscape of things, everywhere else far outweighs the rest of the country as far as large corporations being founded and continuing to produce.

Indiana VC Kelly Schwedland Has Advice for Startups Everywhere Else

Kelly Schwedland is no stranger to entrepreneurship. After a few startup successes, he moved to Chicago to attend the University of Chicago’s Booth School of Business. During his 5 years in the city, he spent a lot of time in and around the infant Chicago startup scene.

Kelly Schwedland is no stranger to entrepreneurship. After a few startup successes, he moved to Chicago to attend the University of Chicago’s Booth School of Business. During his 5 years in the city, he spent a lot of time in and around the infant Chicago startup scene.

Now back in Indiana, Schwedland is using all those years of experience to help local entrepreneurs on the road to success. As an Entreprenuer-in-Residence at Elevate Ventures, he spends most of his days traveling northern Indiana, coaching dozens of teams at various stages in the startup process.

In a traditional venture capital arrangement, the VC provides money, occasional connections, and often a vote on the board. They have little to do with the actual development of a company.

With the help of the Indiana Economic Development Corporation, Elevate Ventures does things a little differently.

“We try and surround the entrepreneur through the entire process,” Schwedland explains.

One way this happens is through varying levels of funding. There are grant opportunities for entrepreneurs looking to develop a product. Angel funds are available for companies with a little bit of early traction, and there is also a diversity fund for women, minorities, and veterans.

Elevate works with a broad range of companies, but they all have 2 things in common:

- They are Indiana-based. The core mandate of the organization is to build Indiana companies.

- They are innovation-driven, usually with a national or global scale.

Once a company wins investment from Elevate, the entrepreneurs-in-residence like Schwedland step in. He helps companies start where they are, both geographically and in the life of their company. From there, he coaches them on how to maximize funds to gain traction and how to pivot into the right business models.

So, what advice would Schwedland give to entrepreneurs everywhere else looking to catch the eye of a VC?

“Traction! It’s hard not to underscore this enough. Unless you have been successful several times in the past, VC’s still look at traction with customers as the primary proof that what you say is true. And, really, they are looking for traction on your business model, proof that a dollar of marketing gets 2+ dollars of profit.”

He acknowledges there are different kinds of traction. 10,000 email addresses of people waiting for your launch is a good starting point. Actual paying clients is even better.

“In the end it all comes down to customer validation,” he says. “And the best validation is when customers give you dollars in exchange for your products.”

In his “spare time” Schwedland is also developing his own resources that give advice based on his own experiences. He likens them to the Silicon Valley pitchbooks, collections of VC advice passed from company to company.

Schwedland’s version will be developed in several different formats. One is a slide deck on SaaS companies and the freemium model. Pulling from research he did in Chicago, the deck breaks down the whys and hows of a successful freemium model.

Another resource will discuss crowdfunding, a popular way to gain both money and traction without a lot of capital. There are plenty of successful and unsuccessful crowdfunding campaigns, and Schwedland will use them to point out a few best practices. One successful campaign he will pull from is that of JustFoods. This Indiana company is developing real food meals for people that must eat from a tube. Their Indiegogo campaign provided just the traction and money they needed to move from idea to product development.

It’s common “knowledge” that funding is one of the biggest challenges for startups everywhere else. We tend to believe that all the money lives on the two coasts.

But Kelly Schwedland and Elevate Ventures are disproving that belief. Not only is there money available for promising companies, VC firms everywhere else are innovating their own industry. Because of them entrepreneurs are better served and more able to succeed.

To learn more about Kelly Schwedland and Elevate Ventures, check out their website.

disclosure: Elevate Ventures is one of our Indiana content sponsors.

How To Deal With The “How Will You Acquire Users?” Question

Venture capital investors ask a lot of tough questions before they sign any checks. One of the hardest is when they start drilling down into your business model and ask “How will you acquire users?”

But in reality this is a difficult question, because even well-known companies like Dropbox might have been hard pressed to come up with a satisfactory answer if they were asked that particular question.

Common answers include such nebulous coveralls like ‘build up a community identity,’ ‘implement viral marketing,’ and ‘create incentive packages’. Maybe these will indeed be persuasive. But, many companies learn as they develop through real life challenges and don’t really have all the answers.

Here we take a look at a few of the particular issues involved in acquiring users which may be more persuasive in wooing VCs over to the cause than the usual stock responses.

Focus

VCs prefer hearing that you’re committed to focusing on a particular market sector rather than how you will target a much wider audience and then go viral. There’s never any guarantee you’ll ‘go viral,’ but narrow the target a little and you’ve got a better chance of hitting the bullseye.

Budget and resources are limiting factors for any startup. If you focus all your energies on one particular sector, you will almost certainly yield far better results because that target sector will see a superior value in your service.

Events that are sector specific are the norm, though there are exceptions to the rule such as targeting engaged couples and college students. With these, there are usually sector-targeted content platforms and/or distribution channels involved that make it easier to penetrate a small but ultimately profitable market, from which you can expand.

Scalability

If you can tell the VC that you have the scaling flexibility to go from a hundred to a hundred thousand subscribers and thereby transform into a sustainable business, this will be music to their ears. Promoting a product one-on-one is not scalability. If on the other hand, you’re able to say that you already have a partnership with Coles Group Ltd in place, this is real scalability built into your business plan, and they’ll be suitably impressed.

Get in early with validation

You need data to back you up. Look into several different types of acquisition strategy and decide which will suit your line of business best. For example, if you took out ads on Google and Facebook and found that SEO is more cost-effective than other methods, this sounds like you has done your homework. If you’ve worked out a conversion rate against costs to come up with a realistic ROI, that sounds even better.

All this is validated data, rather than just a bunch of assumptions tied together with a string of wishful thinking. When presented with such solid data investors can see how an injection of capital will help an early trend to scale up.

Author: Carlo Pandian worked at Adzuna, a tech start-up based in London. He is currently writing a tutorial on QuickBooks (accounting software for entrepreneurs), and has previously published for Techli, Killer Startups and Under30CEO. Connect with him on Twitter @carlopandian.

Atlanta Startups To Win In CTW Breakup

Earlier this summer Atlanta super angel, Sig Mosely came out of retirement. It was announced that he was joining forces with Palaniswamy Rajan to form the $25 million dollar CTW ventures fund. Mosely also participated in a $600,000 round led by Dallas Maverick’s owner and fellow super angel Mark Cuban, in Atlanta startup Badgy.. It’s unclear whether or not it was Mosely or CTW in that round.

Now, just two months after the start of CTW the partners, Mosely and Rajan are parting ways. They are divorcing over what the Atlanta Business Journal is equating to “irreconcilable differences.

Rajan prefers to go long tail on technology ventures.

“Raj much prefers to dig deep, deep, deep into the technology,” Mosley said to the Business Journal “That does not do anything for me.”

Rajan feels the same way about Mosely’s desire to invest in entrepreneurs. Mosely is more of a risk taker which is actually great for startups.

Both men will go there separate ways but that doesn’t mean Mosely is going back into retirement. Mosely is creating his own fund that will invest between $200,000 and $500,000 in entrepreneur lead startups.

Mosely is hoping that his fund will be a feeder fund for deal flow with larger firms like Menlo Park Ventures.

Prior to retiring a first time in 2010 Mosely had oversaw the investment in over 130 technology companies as the President of Imlay Investments.

Linkage:

Source: Atlanta Business Journal

More Atlanta stories from the voice of startups “everywhere else”

Kansas City Startup: AgLocal Raises $1 Million Dollar Seed Round

We told you about Kansas City startup AgLocal back in April. This innovative startup is connecting meat lovers with real meat, direct from the farm, effectively cutting out the middle man which is commonly the grocery store.

We told you about Kansas City startup AgLocal back in April. This innovative startup is connecting meat lovers with real meat, direct from the farm, effectively cutting out the middle man which is commonly the grocery store.

Real true meat lovers want to make sure they have the highest quality cuts of meat without the worry of chemicals involved in processing or trickery used to make the cut weigh more with additives and such that are commonly found in meat packaged at national food chains.

While the vegans and vegetarians of the world may not like the idea behind the Fairway, KS based startup, farmers love it. According to the Kansas City Business Journal, AgLocal has already signed up over 100 farms to be part of it’s direct to consumer network.

Founder Naithan Jones is hoping to grow AgLocal organically (no pun intended) and sees a vision where anyone in the US can pick up their mobile phone and use an AgLocal app to get the best meat delivered to their door.

AgLocal has secured a $1 million dollar seed round led by local investors OpenAir Equity Partners.

Jones left the Ewing Marion Kauffman Foundations Aspiring Entrepreneur FastTrac Program to undertake starting AgLocal.

Jones plans on using the money to add more engineers, build out it’s technology platform and increase partnerships with local farmers.

Linkage:

For more on AgLocal visit them here

Here’s an earlier story on AgLocal from Nibletz the voice of startups “everywhere else”

Here are more stories from “everywhere else”

Nibletz could really use your help with our mission, here check out this link.

New DC Accelerator Acceleprise Embracing Enterprise Tech Startups

Acceleprise is a new Washington DC based accelerator that is targeting new startups in the Enterprise space. TechCrunch recently said that Acceleprise wants to be the “500 startups for Entreprise”

Acceleprise is a new Washington DC based accelerator that is targeting new startups in the Enterprise space. TechCrunch recently said that Acceleprise wants to be the “500 startups for Entreprise”

Acceleprise has great DC based founders in Sean Glass, Allen Gannett and Collin Gutman. They also have some great mentors that include well known founders, executives, venture capitalists and experienced operators. Their mentor list includes Scott Case, head of Startup America, Katharine Weymouth CEO of Washington Post Media, Maria Thomas former CEO of Etsy, Sonny Ganguly CMO at wedding wire and many more.

Their website says they are “The Enterprise Technology Accelerator”. Enterprise was a natural sector to pursue, Glass told TechCrunch’s Sarah Perez that he started thinking about how he wanted to do his personal angel investing. He found while evaluating his portfolio that he had the most success with and was able to help the most in early stages, were all enterprise focused.

Washington DC is also the perfect location for an enterprise focused accelerator. Of course the federal government is the largest enterprise customer in the country. In their immediate surroundings you have most of the largest defense companies and contractors in the world. Accelleprise is also a quick 4 hour drive to New York City and not to far from Atlanta as well.

More after the break

Read More…

Ben Horowitz Sets The Records Straight On Instagram And PicPlz With A Few Words From Mase

The lyrics to Mase’s 1998 hit “Lookin At Me” graced the page of Ben Horowitz, of Andreessen Horowitz, personal blog on Sunday afternoon. Horowitz needed to set the record straight. There’s a lot of haters out there (I know this personally) and people were asking questions. Ridiculous questions if you ask me, but still they were asking.

The lyrics to Mase’s 1998 hit “Lookin At Me” graced the page of Ben Horowitz, of Andreessen Horowitz, personal blog on Sunday afternoon. Horowitz needed to set the record straight. There’s a lot of haters out there (I know this personally) and people were asking questions. Ridiculous questions if you ask me, but still they were asking.

Andreessen Horowitz invested $250,000 in Kevin Systrom’s first company Burbn, and with the $1 billion dollar purchase of Instagram by Facebook the venture capital firm stands to make $78,000,000 thats 78 million dollars for those of you that aren’t good with numbers. That’s a return of 312 times their money. Yet people have been asking why Andreessen Horowitz didn’t make more.

Horowitz took to his blog to explain why they didn’t make more. But first he said:

Ordinarily, when someone criticizes me for only making 312 times my money, I let the logic of their statement speak for itself. However, in this case, the narrative that some critics put forth has the nasty side effect of casting two outstanding entrepreneurs—Kevin and Dalton Caldwell—in an unfair light and glosses over an important ethical issue that we faced. As a result, I will clarify what happened and why we didn’t make even more money.

More after the break

Read More…

St. Louis Arch Angels Invest $3 Million In 2011

We love angel funds with great names like Arch Angels (get it St.Louis, Arch, Arch Angels?). The group of investors that has been around since 2005 announced their biggest year in funding was 2011 with $3 million in investments in a variety of early stage sectors. Their investments range from health technology, to beverages and even backing a downtown St. Louis accelerator fund.

We love angel funds with great names like Arch Angels (get it St.Louis, Arch, Arch Angels?). The group of investors that has been around since 2005 announced their biggest year in funding was 2011 with $3 million in investments in a variety of early stage sectors. Their investments range from health technology, to beverages and even backing a downtown St. Louis accelerator fund.

The angel group has 47 members and have invested $26 million in 28 companies since their founding in 2005.

Their leading investments in 2011 were $500,000 to Pulse Technologies. The health care company is working on developing a medical device to boost the effectiveness in clot dissolving drugs.

The groups second largest investment was $173,000 in a beverage company developed by Robert Paul, a neuropsychologist who after hearing about brain drinks decided if it was going to be done right he would do it himself. Arch Angels investment was part of a $900,000 round that also included former executives of Anheiser Busch.

Arch Angels other investments were in two more medical companies, Katalyst Surgical which received $123,000 for opthalmic instruments and $220,000 in Venti a medical device company focused on diseases of the veins.

They also contributed $375,000 to Capital Innovators the downtown accelerator fund. Capital Innovators has backed 12 startups that showed off their projects at a demo day held in the beginning of the month.

source: Stltoday.com

Another Day, Another Possible Black Mark On Pinterest

Another day, another possible black mark on Pinterest. The site that has been marked in the past with Link Baiting, Spam issues, and copyright infringement maybe up to it one more time. Business Insider is reporting that “VC’s” are trying to get a new round of investment valued for the company at around $1 billion dollars. There is just one problem with that, everyone they’ve called to talk to has denied it with no known knowledge of a new round. Nor does Pinterest “want” to raise a new round of funding as of yet they claim. This is also a company that still has no business model for revenue yet as their past one with links didn’t work out.

What they are hearing is VC’s are trying to bribe and are showing up uninvited to Pinterest in hopes of starting those talks.

Could it be a rogue investor trying to drum up more interest as one of the original investors as either bringing more money in or a possible exit plan? Or could it just be that Pinterest is trying to drum up hopes of another round, so that hopefully someone buys them out instead.

Source: Business Insider