One of the biggest steps in supporting startups in 2012 was the passing of the JOBS Act. The act itself was passed earlier this year and then turned over to the Security and Exchange Commission (SEC), to develop regulations. The JOBS Act is the legislation that will eventually make it possible to use crowdfunding sites, similar to how Kickstarter functions, to sell off micr0-equity stakes in companies up to $1 million dollars.

One of the biggest steps in supporting startups in 2012 was the passing of the JOBS Act. The act itself was passed earlier this year and then turned over to the Security and Exchange Commission (SEC), to develop regulations. The JOBS Act is the legislation that will eventually make it possible to use crowdfunding sites, similar to how Kickstarter functions, to sell off micr0-equity stakes in companies up to $1 million dollars.

The SEC had originally announced that they would be done setting up the regulations back in July, however that was quickly moved to January of 2013. At this time it’s unclear as to when crowdfunding for equity in startups will officially start.

Several “crowdfunding” startups have launched. Others have launched websites with beta invites and LaunchRock’s in preparation for when they’ll truly be able to crowdfund for equity. Other sites have set up the ability to support startup companies with mico investments in exchange for “perks” like t-shirts, swags and hardware samples.

Barry Rickert, a 40 year veteran in the private equity field, has used his vast knowledge and experience, along with the law, to side step the JOBS Act and create a way to fund startups now.

His Richmond startup, Lendingclouds, is going to give back royalties instead of equity and to get that you need to join the sites “club”.

The combination of royalty based small business financing offers no debt and no personal guarantees to small business that need capital to grow, while at the same time giving investors access to high yield investments that pay immediate income. It’s really quite ingenious. The members only, online Crowdfunding Investment store brings together entrepreneurs and investors in a unique manner designed to benefit both. The funding group provides exclusive investment opportunities to members who bring as little as $100 to the table. Lending Clouds does this by accepting applications from entrepreneurs, which once approved, are offered to investors.

The combination of royalty based small business financing offers no debt and no personal guarantees to small business that need capital to grow, while at the same time giving investors access to high yield investments that pay immediate income. It’s really quite ingenious. The members only, online Crowdfunding Investment store brings together entrepreneurs and investors in a unique manner designed to benefit both. The funding group provides exclusive investment opportunities to members who bring as little as $100 to the table. Lending Clouds does this by accepting applications from entrepreneurs, which once approved, are offered to investors.

Investor members participate in what is known as crowdfunding. Rickert’s form of crowdfunding is focused on pooling resources to invest funds in new businesses, products and ideas that provide royalty based returns. Members are able to spread their funds amongst many different investments, which lessens their risk. Returns of 25%+ are expected on successful ventures. In 20 years, this can result in a $5,000 investment paying $1 million.

“We’re looking forward to working we people who have never invested before,” says Lending Clouds President, Barry Rickert, “and who may have a few hundred dollars or more to put towards various projects and products. There are a few unique aspects to Lending Clouds and crowdfunding, which makes us especially attractive to investors and entrepreneurs.” Rickert adds, “Unlike the stock market, investors don’t need a lot of money, and they start to see payments come back to them within 60 to 90 days.”

Members have access to exclusive listings posted on the Lending Clouds online store. They may read through the various opportunities and decide to put money in one or more projects. Once all funding is in place, an Investment Club is created as the vehicle for making the group investment. The club money is released to the user/grantee (entrepreneur) in return for a royalty agreement that details the product or service to be sold and the royalty to be paid over the term of the agreement. Investors start to receive payments as per the agreement between the user/grantee and grantor/investor usually within 30-90 days.

Rickert notes, “The opportunities we are providing investors with are easier to understand than stock offerings, with terms explicitly stated. Our investment opportunities are for expansion and growth with entities that are already established and familiar to our investors. This also helps to lessen risk.” He observes, “Grantees are looking for as little as $25,000 and as much as $2 million, with the average fund being capitalized at about $100,000. An investor can put as little as $100 into a fund.”

As part of Rickert’s lean startup strategy, he is giving away a significant number of $100 credits to new members, with no strings attached. About the only catch (if you can call it a catch) is that investors must pick an investment that gets funded. However, if it doesn’t, they’re free to use the funds to pick another investment. Rickert also states that while the offerings are very small today, he has some million dollar deals in the pipeline.

While hundreds of crowdfunding sites popped up the minute the JOBS Act was officially passed, Lending Clouds is not a flash in the pain, or a scam. Rickert has decades of experience in the field and has come up with the quickest, easiest and most legal way to start using crowdfunding mechanics to invest now, not when the SEC is ready.

Linkage:

Go see for yourself at lendingclouds.com

Here are more startup stories from “everywhere else”

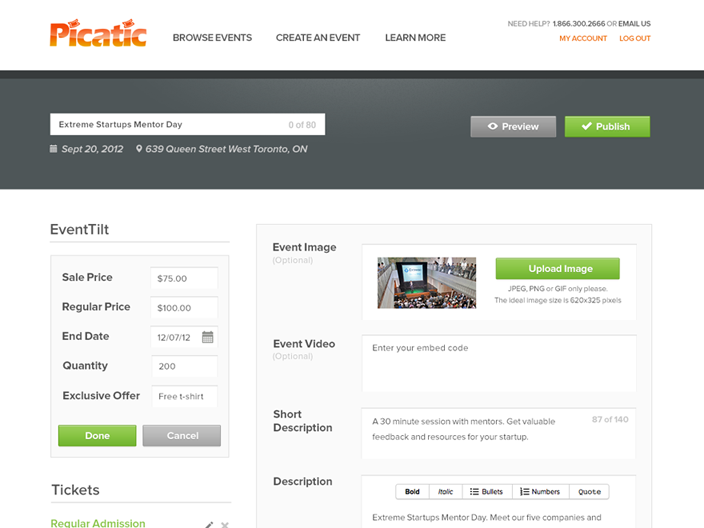

Crowdfunding will be big at the largest startup conference in the world

Crowdfunding is about to take the world by storm. With the passage of the JOBSact last year, companies will soon be able to crowdfund early stage investment rounds up to $1 million dollars, from anyone with a pulse and an internet connection.

Crowdfunding is about to take the world by storm. With the passage of the JOBSact last year, companies will soon be able to crowdfund early stage investment rounds up to $1 million dollars, from anyone with a pulse and an internet connection.