I ask for and receive a lot of requests for introductions. Whether it’s someone at a company looking for a partnership or job, an investor, a journalist, or someone else, it’s an integral part of pretty much any profession. At the same time, such requests often arise in the least efficient way possible for the middleman: in person, in the middle of another email exchange talking about the other party, or simply with no details at all.

I ask for and receive a lot of requests for introductions. Whether it’s someone at a company looking for a partnership or job, an investor, a journalist, or someone else, it’s an integral part of pretty much any profession. At the same time, such requests often arise in the least efficient way possible for the middleman: in person, in the middle of another email exchange talking about the other party, or simply with no details at all.

Once I got involved in the startup scene with Fetchnotes, I found that the startup crowd has email introductions down to an exact science. I’m sure similar rules apply outside our bubble, but inside it there are a very specific set of expectations, and it was a bit cryptic and counterintuitive to pick up at first. But hopefully this helps you maximize the success of your introduction requests.

First of all, no matter where the request for an intro arises, always send a separate request email. That way, the receiving party can act on it directly (since most intros are over email). You’re asking someone to spend their social capital on you, so your number one goal is make it as easy as possible. Here’s how:

—

Hey Alex,

Hope all is well! I saw you’re connected to Mark Zuckerberg (contact) on LinkedIn. I was hoping to connect with him about a partnership (reason), the details of which are below. Do you know him well enough to make an intro (gives middle-man a way out in case they don’t know each other well)?

StartupWithFriends is an awesome new app that lets you start a company with your friends, right on Facebook (what you do). We have 150K+ active users, and on average they’re starting 1,000 companies per day (credibility + traction). We’ve been integrating with OpenGraph already (shows you’ve done work already, otherwise they often point you to their API page) but we think that we can make it a huge revenue driver for them if we get access to some of the data not available in their APIs, specifically the number of times a user looks at the profiles of their ex-girlfriends (basic benefits + needs outlined).

Let me know if you can make the connection. If not, no worries, I can reach out cold (shows them you have confidence that this is going to happen one way or another).

Thanks!

Networker McAwesome

—

When I receive an email like this, I forward it to my contact and ask, “Hey, these guys were looking to connect. Can I make an intro?” If he says yes, I make the connection. If not, I say I tried but he doesn’t want to talk. Unless you know someone really well (or know they are looking for such opportunities), you want to give them a chance to say no. Otherwise, they’ll feel obligated to take it and have bad feelings toward the person from Day 1. Not only is it just good etiquette to give them a choice, but it prevents the value of your introduction from being diluted too.

Is it contrived? Obviously. Does the other party realize its contrived? Usually. And yet I write every email intro request in this exact format because it does three really, really important things:

- Makes it easy for the middleman to make the intro (just hit forward and type a sentence)

- Gives the person you’re trying to get connected with a basic overview (so they feel more comfortable taking a meeting)

- Limits the amount of aggregate back-and-forth.

That makes the intro more likely to happen, the person you’re trying to meet more likely to take the meeting, and most of all, makes the most efficient use of everyone’s time.

Happy connecting!

This post originally appeared on the author’s blog.

Alex Schiff is the founder and chief executive officer of Fetchnotes, which makes productivity as simple as a tweet. Prior to Fetchnotes, Alex was the vice president of Benzinga and a student at the University of Michigan’s Ross School of Business.

The Young Entrepreneur Council (YEC) is an invite-only organization comprised of the world’s most promising young entrepreneurs. In partnership with Citi, the YEC recently launched #StartupLab, a free virtual mentorship program that helps millions of entrepreneurs start and grow businesses via live video chats, an expert content library and email lessons.

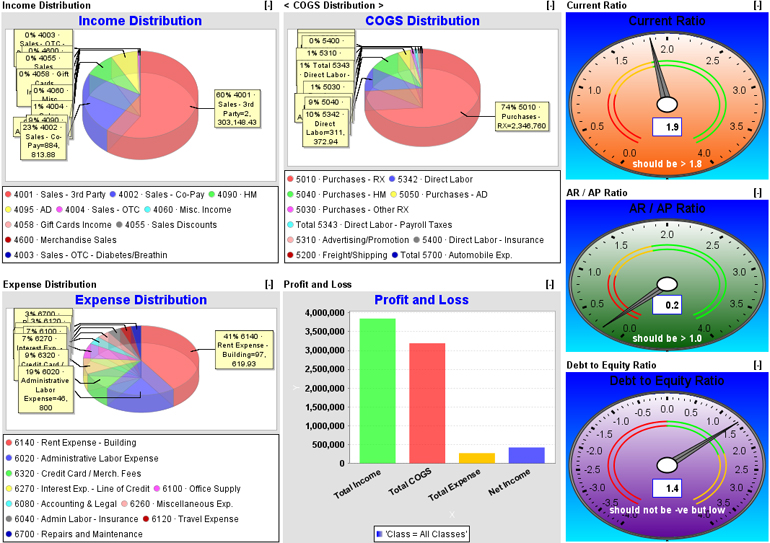

businesses more comfortable and easier to run. But as a young startup, you have no such luxury! Because it’s important to make every dollar count while your business

businesses more comfortable and easier to run. But as a young startup, you have no such luxury! Because it’s important to make every dollar count while your business