Rick Holton Jr. And his brother Rob Holton are no strangers to the St. Louis startup scene, tech scene or business scene. The Holton brothers come from a long and historical pedigree in the St. Louis area. Their mother Lotsie Hermann Holton is actually the granddaughter of August “Gussie” Busch from the Anheuser-Busch family.

We met the Holton Brothers on Friday when the Nibletz sneaker strapped startup road trip pulled into St. Louis for a quick overnight stop. We were there to meet with our friends at LockerDome. We had asked Gabe Lozano to introduce us to someone very influential in the St. Louis startup scene, preferably someone part of the Arch Angels, angel investor network.

Rick Holton and Rob Holton, through their investment company, Holton Capital, are members of the Arch Angels. Rick Holton is also one of the principals in the fund that came out of the Arch Angel group, Cultivation Capital. Notable St. Louis alum Jim McKelvey, co-founder of Square is also a principal in Cultivation Capital, as are Brian Matthews, Peter Esparrago, and Cliff Holekamp. Together the fund is backed by $20 million for funding startups.

But the story here doesn’t lay in the background of St.Louis’ growing tech startup community. The story is about what Rick Holton Jr has been very excited about lately, and that is synergy.

When we arrived at Holton’s office Cameron and I were under the impression that Holton had expected to hear a pitch from us. Yes we absolutely need money but we’re not sure VC money is the way to go. We were at Holton Capital’s offices to get the story. The story about how and why, all of the sudden St. Louis keeps popping back up in the tech and startup news.

We are hearing about Arch Angels, Cultivation Capital, BonFyre, LockerDome, and countless other companies, funds and investors on a regular basis. Heck St. Louis is so hot that Edward Domain moved tech.li to St. Louis from Chicago after a $50,000 grant from Arch Grants.

It’s not like the Holton’s or any of the other partners in Cultivation Capital or angel investors in Arch Angels, are strangers to investing. Holton Capital has been investing in companies for over a decade.

Rick Holton explained that with their company they had invested heavily into a variety of companies. They have a classic car company, a framing company, investments in several life sciences companies and of course technology. Rick quickly confirmed with his brother and then told us that Arch Angels has $30 million invested so far.

St. Louis is an extremely loyal town. Earlier in the morning Jim Enright and Mark Sanders at LockerDome told us that if you went down the street in downtown St.Louis 9 out of 10 locals could tell you everything that happened in the most recent Cardinals game. After a quick test they were right.

But even as loyal as St. Louis can be Holton was concerned that some people may have the perception that St.Louis is a dying industrial town, rather than the thriving tech town that it is.

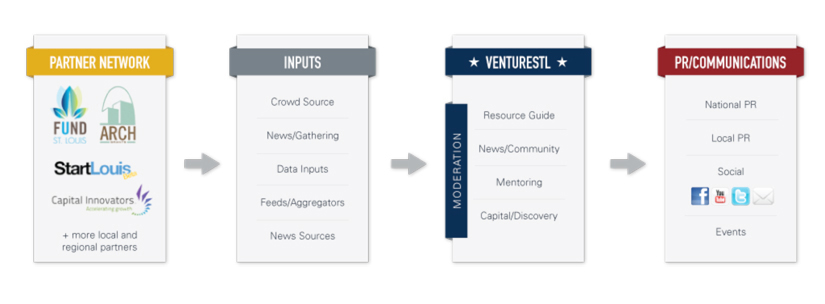

Holton’s other major concern was that all the startup and tech resources weren’t talking to each other. Through Holton Capital and his work with FinServe Angels and Arch Angels Holton is extremely plugged into the tech and startup ecosystem in St. Louis but he kept finding that not many others were.

Holton explained that he would hear about one deal from someone and suggest another possible investor that would be perfect for the opportunity but they didn’t know each other. “People weren’t talking to each other and because of that they were competing with each other when they didn’t have to be”.

At this point in our discussion Holton has moved from reserved to completely animated. If you don’t know Holton personally, he stands at a towering 10 feet, ok not really but he is very tall. He’s talking extremely fast and moving his hands around explaining to us, with the excitement that you’d expect when Mark McGwire was still belting them out of the park.

You can tell that this non-communication between tech influencers in St. Louis was something Holton was becoming passionate about. So he called a meeting.

Holton invited 15 of the top tech and startup influencers in St.Louis to the meeting in his boardroom on January 26th. Among the invitees were other venture capitalists, influential local tech blogs, partner resources and entrepreneurs.

Of those 15 people invited only 47 of them showed up. Holton Capital has your average modest sized conference room. Holton was fitting all of these interested tech folks wherever they could. At one point, as Holton actually showed us, they moved every chair in the office into the conference room.

“What I expected to be a 45 minute to an hour meeting of introductions and handing out business cards turned into a strategy session that lasted over two hours” Holton said.

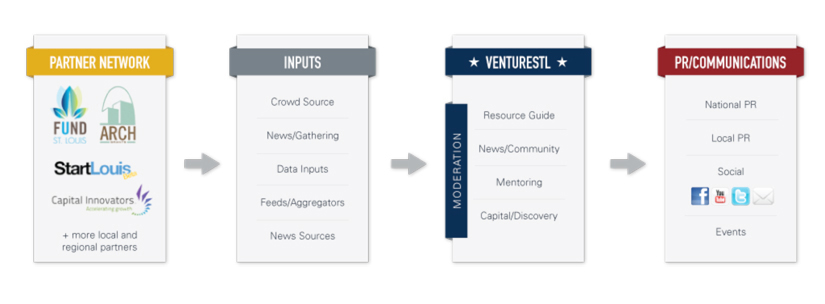

Out of that meeting new partnerships were formed, new friends were made, and VentureSTL was born.

VentureSTL is a new web portal connecting everyone in the St.Louis startup and tech community to each other with news, discussions, links and profiles. Holton believed so much in VentureSTL that his own holtoncapital.com forwards to the site.

VentureSTL is a new web portal connecting everyone in the St.Louis startup and tech community to each other with news, discussions, links and profiles. Holton believed so much in VentureSTL that his own holtoncapital.com forwards to the site.

Holton is very optimistic about the companies that are growing right in St. Louis. Two of the more notable startups are LockerDome and BonFyre. Holton and the others involved in VentureSTL, the meeting that VentureSTL was born out of and everyone affiliated with Arch Angels are doing what they can to keep St. Louis startups in St. Louis and attracting new companies, like tech.li to St. Louis.

St. Louis has some big stars in this web 2.0 wave. Most notably would be Jack Dorsey from Twitter and Square and Jim McKelvey, also co-founder of Square. McKelvey loves St. Louis and is committed to helping Holton and company with the St. Louis mission, Dorsey, not so much.

Linkage:

Connect to VentureSTL here

Nibletz is the voice of startups “everywhere else” here are more new stories from “Everywhere Else”

As for us, we’re crowdfunding and could use your help here