After Thanksgiving many startup and tech sites feverishly began telling the story of doom and gloom for startups, follow on funding and startup accelerators.

After Thanksgiving many startup and tech sites feverishly began telling the story of doom and gloom for startups, follow on funding and startup accelerators.

This vicious news cycle began with the Dow Jones VC Edge report released at the end of November. The report highlighted many positive things, including growth for some key areas in high growth potential tech sectors both here and abroad. Fred Wilson, the principal at Union Square Ventures and a respected authority in the startup and VC space, was quick to point out that VC funding for consumer web and mobile companies was down 42% in the first 9 months of 2012.

The Dow Jones report coupled with Wilson’s commentary sent a tremor through Silicon Valley that we could be on the cusp of a bubble.

While startups and high growth potential technology companies are contributing to job growth, what’s not being considered is the fact that his down turn in VC funding may actually be more of a leveling off.

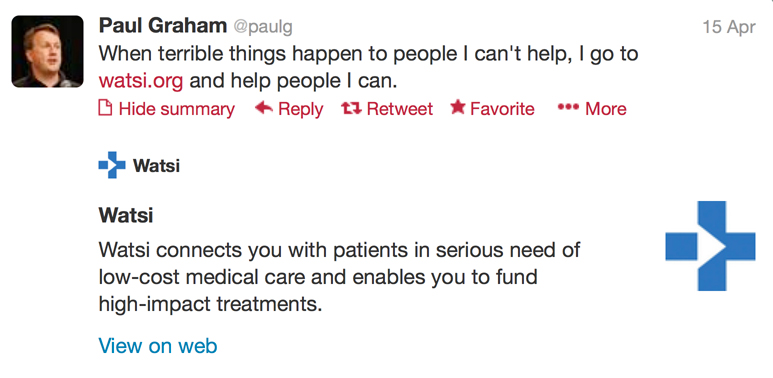

The same week the Dow Jones report and the Wilson piece came out, Paul Graham, founder of YCombinator sent out more troubling news. Again, interpreted at some of the startup and tech sites as bad news.

Graham had explained how the next cohort of YCombinator companies would receive less funding. The very next day Graham again took to the YCombinator blog to let everyone know that the class size was shrinking as well.

For a startup accepted into the program it instantly meant prestige and validation, not to mention a huge six figure seed investment. Reading the news from Graham made people all around start doubting the accelerator model. PandoDaily quickly opined. Erin Griffith, a writer for Pando Daily, said “We know accelerators are headed for a shakeout- but do they“? Griffith pointed out that there were over 100 startup accelerators across the country churning out thousands of startups with only a 10% success rate.

But what’s really happening in accelerators and across the startup space, is that people are getting more conservative in the valley  because they’re used to a culture of ginormous funding rounds and even bigger exits. Everyone knows the story about Color. Everyone’s also seen the value of the Instagram Facebook deal diminish as Facebook’s stock went down hill fast. Truth be told, even after the $1 billion dollar Facebook deal, Instagram still had less than 25 employees when they moved into Facebook’s offices back in September.

because they’re used to a culture of ginormous funding rounds and even bigger exits. Everyone knows the story about Color. Everyone’s also seen the value of the Instagram Facebook deal diminish as Facebook’s stock went down hill fast. Truth be told, even after the $1 billion dollar Facebook deal, Instagram still had less than 25 employees when they moved into Facebook’s offices back in September.

That billion dollars really produced a lot of jobs right? Consider the fact that the $1 billion dollar Instagram Valuation was more than the New York Times is currently worth and they employ over 10,000 people.

The real question about accelerators is really about whether the goal behind an accelerator is to help yield larger than life venture investments or is it about building companies with solid foundations and solid founders. It is about the cash or the wave of now more educated entrepreneurs who may not get their first startup entirely off the ground but may hit a home run or even just a double in the next go round?

It seems accelerators with the real goal of producing these crazy funding rounds and crazy exits are no better than public schools who are just teaching whatever standardized test it is to graduate the next class.

The beauty about accelerator programs “everywhere else” is that the startups in the programs are being taught important lessons about starting up, business and even life.

It’s awesome that YCombinator and TechStars have mentor networks that read like a “Who’s Who” in the startup and tech world. Every startup founder wants to learn from these great mentors, and they can, sometimes even in small towns. Take Oklahoma City’s Blueprint For Business accelerator. They all got a chance to learn from a day with Brad Feld.

Perusing the websites of startup accelerators outside the valley (everywhere else) you don’t typically find a “who’s who” of the startup and tech world. What you do find is a “who’s who” in most local business communities.

Startups may apply to programs like the Fort in DC because they want to be close to the epicenter of government. They may apply to the Brandery in Cincinnati because they want to be close to the biggest branded company in the world, Proctor & Gamble. Startups that are logistically focused or enterprise focused may want to apply to Seed Hatchery in Memphis to be close to FedEx. Startups in the entertainment and music space may choose an accelerator in Los Angeles or even Jumpstart Foundry in Nashville.

While some of these accelerators “everywhere else” may have mentors from the Valley participate or founders with big exits, the bulk of their mentor list is either mentors who speak to their niche or mentors in the local community. Which can be equally, if not more important than name brand mentors elsewhere.

Are you building solid companies or is the accelerator only looking for “the next big thing”?

Linkage

Apply for SeedHatchery here

Check out these accelerator stories from nibletz, the voice of startups “everywhere else”.

And check out the two great accelerator panels at the everywherelse.co The Startup Conference, the biggest startup conference in the U.S

The extremely popular British boy band One Direction sells everything in the world with their logo on it. Go into a retail store of any kind, and you’ll find 1D branded merchandise from bed sheets to school supplies to talking dolls and everything in between. In fact the band makes more off licensing than album sales. But when the lads decided to raise money for charity, they decided they needed a little help.

The extremely popular British boy band One Direction sells everything in the world with their logo on it. Go into a retail store of any kind, and you’ll find 1D branded merchandise from bed sheets to school supplies to talking dolls and everything in between. In fact the band makes more off licensing than album sales. But when the lads decided to raise money for charity, they decided they needed a little help.