Austin Allred is the founder of Grasswire, who moved from Utah to the Valley and lived in his car for 3 months until raising capital.

Episode 9: Jon Bradford of Techstars Says How To Get Into Accelerators

Jon is Managing Director of TechStars London and has previously founded and worked on startup accelerators around the globe. He’s co-founder of F6S.com which has grown into one of the most important startup program platforms in the world, and has recently cofoundedtech.eu to feature startup and tech news across Europe.

Our interview had so much great content we decided it was worth 2 episodes rather than cut out such valuable knowledge. In part 1, Jon explains:

- How to get into accelerators

- What investors are looking for

- How to build a good team

- Shifts in startup accelerator models

- How to use crowdfunding to your advantage

How things got started

Jon shares with us how he went from being a “bored accountant” at a major firm to launching his first startup (made a ton of money) becoming a VC, joining Techstars and being part of the growth of the tech startup world.

We then dive into his opinion on the changes in how startups can get off the ground, how to get into accelerators, and what people like him (the decision maker) are looking for when making those decisions.

Don’t miss Part 2! You can contact Jon at jon at techstars dot com

Detroit Startup UpTo Closes $2 Million Series A, It’s Like FourSquare For The Future

Check in apps have come and gone. Of course the biggest player in the space is still probably FourSquare. After that is Facebook checkins or even Google Plus. I personally find the only time I actually use FourSquare is when I’m at a big tech event. Judging by my FourSquare feed, I’m not the only one who has resorted to part time checking in.

Check in apps have come and gone. Of course the biggest player in the space is still probably FourSquare. After that is Facebook checkins or even Google Plus. I personally find the only time I actually use FourSquare is when I’m at a big tech event. Judging by my FourSquare feed, I’m not the only one who has resorted to part time checking in.

But what if there was an app that could tell you where I’m checking in later. I don’t necessarily want to open up my schedule to everyone in the world,but between events, being a parent, and the sneaker strapped startup road trip, I typically catch up with someone a few weeks later and they were like, “hey I can’t believe I missed you at xx event.” I’d imagine most of my colleagues and most of our readers are pretty busy people. Typically if I check in on FourSquare or Facebook or even on Twitter, at an event, it’s too late to get on my schedule.

Well Detroit startup UpTo is taking that pain away. By opening up the parts of your calendar you want to share socially, your friends, colleagues, and family members can see where you will be later in hopes that maybe you can schedule something social or for work.

I like this idea a lot, and so do investors.

UpTo raised a pretty hefty seed round of $875,000 back in 2011. Now they’ve just closed on a $2 million dollars Series A round.

The downtown Detroit-based startup currently has 9 employees and plans to add even more. They also plan on evolving the platform to include interest-based entries like concerts and sporting events. They’ve incorporated more calendar features and even a business-to-business component as well.

“UpTo is now a full calendar with social networking instead of the other way around,” Founder and CEO Greg Schwartz told Xconomy. “A lot of users wanted to use UpTo as an every day calendar. We realized we could be highly differentiated from every other calendar.”

Detroit Venture Partners, Venture Investors, and Ludlow Ventures all participated in the round.

“[The $2 million round] allows us to really focus on building our sales team and the growth of B2B,” Schwartz says, adding that the company plans to hire four or five people within the next few months. “Right now, we’re focused less on selling and more on building our network,” he says. “We want to grow our customer base to the point that we look back and say, ‘I can’t believe we had calendars that were so static.’ ”

You can check out UpTo here.

Wisconsin Governor Signs Investment Capital Bill For Startups

Wisconsin startups just had another victory on Thursday as Governor Scott Walker signed an investment capital bill.

Wisconsin startups just had another victory on Thursday as Governor Scott Walker signed an investment capital bill.

The bill, which drew bipartisan support in the state legislature, provides $25 million dollars to startup companies in Wisconsin. Unlike other states, though, this bill was specifically for tech startups vs biotechnology and life sciences. In most states it’s harder for general tech companies to draw this kind of support from the government.

In the case of the Wisconsin bill, startups in agricultural technology, information technology, engineered products, advanced manufacturing, medical devices, and imaging are all eligible for the new funding.

While biotechnology and life sciences companies can create jobs over a much longer period of time, Wisconsin is looking for companies that can create jobs quicker.

“The $25 million allocated for this program in the state budget will help grow private sector jobs by investing in start-up companies,” Walker said in a statement. “One hundred percent of the funds from this program will go to Wisconsin-based businesses, and there are a number of measures in place to ensure accountability and transparency for the hard-working taxpayers.”

Fox11online.com reports that the $25 million dollars in tax payer money will be matched with $50 million in private donations.

“I hope that once success is shown, it will lead to additional measures to increase the amount of capital for new businesses and more Wisconsin jobs,” Walker said in a statement.

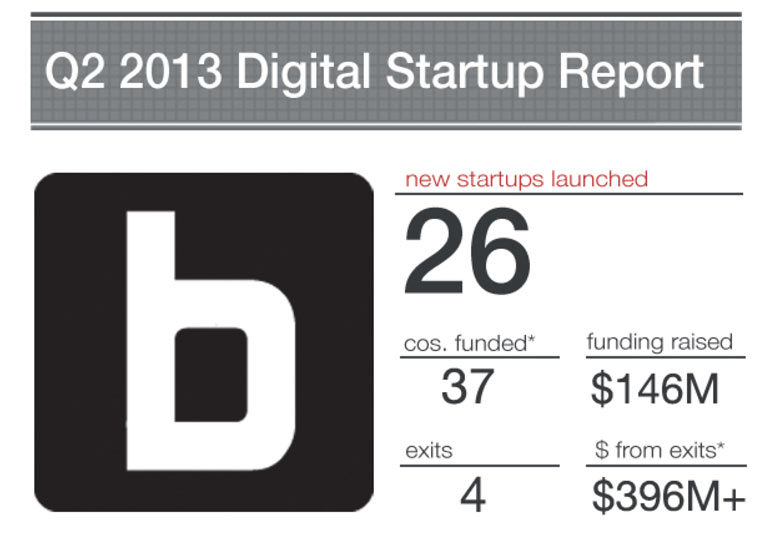

Chicago Startups Raise $146 Million In Q2 2013

Wow! Builtinchicago.com has published their latest Digital Startup Report for Q2 2013. As expected the Chicago startup community has performed extremely well. 37 startups raised $146 million dollars in the second quarter of 2013.

Wow! Builtinchicago.com has published their latest Digital Startup Report for Q2 2013. As expected the Chicago startup community has performed extremely well. 37 startups raised $146 million dollars in the second quarter of 2013.

If you’ve ever been to visit Chicago’s startup and technology scene you would see for yourself the creators, the innovators and the synergy that surrounds the third largest city in the United States. Two weeks ago we were in Chicago for Chicago TechWeek 2013 where over 100 different startups were showing off their stuff. In addition they hosted a job fair, where over 1000 engineers, developers and designers pined for jobs from over 100 Chicago based technology companies.

Chicago being a focal point for technology in the midwest is nothing new. Big Marker published this infographic in celebration of Chicago TechWeek highlighting some technology companies like CDW, Cars.com, and Groupon that have become household names.

In the second quarter of 2013 Chicago saw 26 new startups launched, 37 companies funded, and 4 exits to the beat of $396 million dollars.

These Chicago companies raised money in Q2 2013:

- AvantCredit

- Blitsy

- Blue Health Intelligence

- Care Team Connect

- CareXtend

- Civis Analytics

- ClaraStream

- Fandium

- Fooda

- GreenPSF

- Healthation

- Inventables

- Narrative Science

- Neohapsis

- OptionsCity

- Optyn

- Pangea

- Pervasive Health

- Project Fixup

- Purple Binder

- Resultly

- Rocketmiles

- SimpleRelevance

- SocialCrunch

- Spare To Share

- Supply Vision

- Target Data

- Total Attorneys

- uBid Holdings

- walkby

- Whittl

- Whoozat Inc

- YCharts Inc

- Purchasing Platform

- Zipfit

These are the companies that made an exit in Q2

- Textura (IPO)

- Acquity Group (Acquired)

- Spooky Cool Labs (Acquired)

- Cartavi (Aquired)

Source: Builtinchicago.com

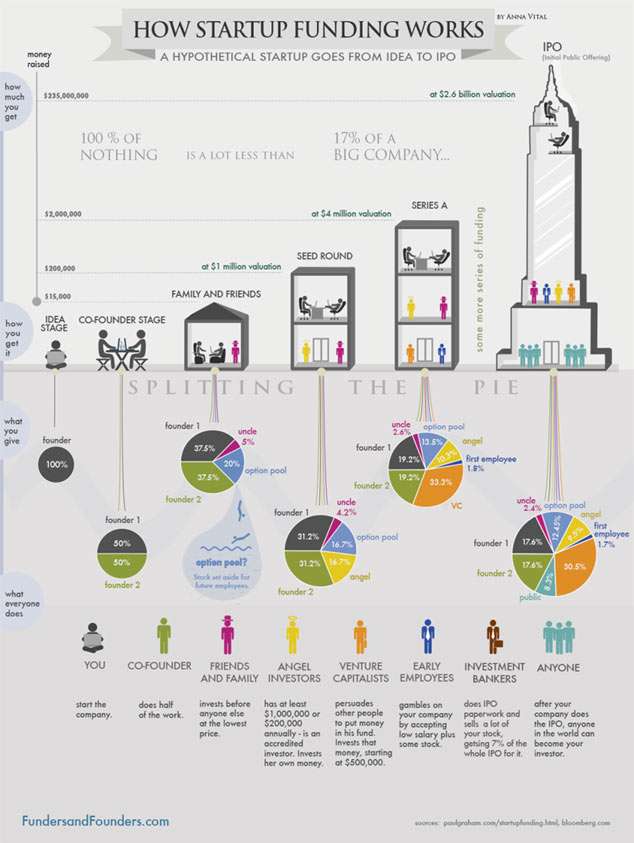

How Startup Funding Works In An Infographic

Everyone wants to know the secrets behind getting your startup funded. We receive hundreds of emails every week asking questions about funding. People really want to know how to get funded and what a startup needs to do to get funded. Access to capital and access to talent are still the most prevalent issues facing startups “everywhere else”.

The good folks over at funderandfounders.com have compiled a great infographic that takes a look at a hypothetical startup and the way they get funded.

The infographic chronicles the most common funding steps for startups that actually make it. We’re all too familiar with the statistics on startups failing. Taking a startup through idea stage, cofounder stage, family and friends, angel round, seed round, Series A, and then eventually (hopefully) IPO.

Of course there are a lot of startups that will fail, a lot of startups that will choose to bootstrap, and some startups that can go direct to revenue. Whatever your path, the infographic below is a fair representation of the funding process. The accompanying article at fundersandfounders explores each stage indepth.

source: Fundersandfounders.com

Now check out Billion Dollar Startups In A Beautiful Infographic.

Andreessen Horowitz & More Back DC 500 Startups Company Spinnakr

We’ve been in DC meeting startups from 1776 DC, hearing Mayor Vince Gray speak, attending a party for Speek, and also attending AngelHack. And, there’s other big news.

This morning Spinnakr announced a substantial seed round led by iconic Silicon Valley venture firm Andreesen Horowitzh. Co-founder Michael Maynerick wouldn’t comment on the exact amount, but he told Nibletz that the round was “substantial.” It also included 500 Startups, Point Nine Capital, Sand Hill Angels, and others.

Last year the Washington, DC company was chosen for the 500 Startups accelerator program in Silicon Valley. While the team moved across the country (and is still out there), Mayernick is still firmly planted in the DC Tech scene. He’s one of the organizers for the DC Tech Meetup, the curator for Startup Digest DC, and was named a Tech Titan by Washingtonian Magazine in 2011.

Back in March when we visited 500 Startups, we spoke to Mayernick, who talked about how important it was to lay foundational roots in Washington DC before trekking out to 500 Startups. Dave McClure, the founder and Managing Partner at 500 startups, grew up and went to college not too far from Washington, DC. Paul Singh, a 500 startups partner who has now ventured out on his own, is also from the DC area. Markerly, founded by Sarah Ware and Justin Kline, is also a DC startup that went out to 500 Startups for the 2013 winter session.

For the past year, the company has quietly been working on a novel approach to web optimization. “We found it intolerable that users should have to do all this work to extract any value from their analytics,” noted Spinnakr co-founder Adam Bonnifield in a statement. “We saw a future of analytics where insights are simply delivered to you, alongside actionable recommendations that you can deploy instantly.”

Here’s how it works: Spinnakr’s novel real-time insight engines analyze the endless stream of visitor data the instant a visitor arrives to a site. These insight engines can detect changes and trends on the fly, such as the arrival of a certain type of visitor, a spike in a set of search terms, or a surge of traffic from an article. Site owners are notified immediately of the event and are empowered to “respond” to these events by changing their site or adding custom messaging targeted to that visitor segment. These changes can be made directly in the Spinnakr application, sent from an email, or crafted using Spinnakr’s on-site editor. Once the changes are made, this custom messaging is shown to arriving the visitor segment. Over time, this leads to a powerful and complete personalization of a site owner’s content.

Spinnakr’s real leg up on the competition: traditional analytics products require you to analyze meaning by working through charts and graphs, a process that takes time and expertise. “Spinnakr automatically discovers these insights in real-time, and tells you exactly what you need to do to benefit from that intelligence, closing the loop as quickly as the data comes in,” Maynerick said.

Bonnifield adds, “All of our evented insights contain actionable recommendations to boost signups and sales for our users. They can choose to accept the recommendation, and if they like, deploy custom, targeted messaging to their site to respond to the traffic event directly from the app.”

Notably, Spinnakr has found so far that this approach to website optimization produces strong and immediate improvements in conversions that significantly outperform existing approaches. Spinnakr users frequently see over 100% conversion lift on messaging compared to the 10 – 30% typical of traditional web optimization methods like A/B testing.

Spinnakr’s founders believe this represents a new web analytics paradigm for the big data era. “When people think about website optimization they think of a slow-moving, marginal process,” said Mayernick. “But the world is filling up with data, creating an endless stream of opportunities. The real winner is the person who can discover them instantly and react in moments. We see a future where analytics will work this way, and we believe we’re building the product that will help define it.”

Spinnakr currently serves SMB, ecommerce, and emerging enterprise customers, while currently optimizing 10 million page views per month.

Spinnakr founders Mayernick and Bonnifield had previously built some of the first online targeting systems used in politics, working with Congressional, Senatorial and gubernatorial campaigns while setting fundraising records in 2006 and 2008. Spinnakr was previously awarded the top startup at both the Data 2.0 Summit and the Founders Showcase.

Check out Spinnakr here.

See what DC Mayor Vince Gray had to say about DC Tech this week!

Check out this must attend conference early bird deals are almost up!

Texas’ Cowtown Angels Announces Largest Investment To Date

The Fort Worth Texas based Cowtown Angels, part of TECH Fort Worth have announced their fourth and largest investment to date. Cowtown has invested $620,000 into Wisegate Inc. This was also the first time that Cowtown Angels have led a round of financing.

The Fort Worth Texas based Cowtown Angels, part of TECH Fort Worth have announced their fourth and largest investment to date. Cowtown has invested $620,000 into Wisegate Inc. This was also the first time that Cowtown Angels have led a round of financing.

The Cowtown Angels members have invested $1,415,000 in four companies to date and currently have two more deals under consideration. In addition to Wisegate, members have invested:

$345,000 in PerioSciences, which has developed a line of antioxidant oral care products

$125,000 in National Dental Implant, developing a non-surgical tooth replacement for non-functional teeth

$325,000 in Inview Technology Corporation, a developer of compressive sensing cameras.

Wisegate is an online community designed to enable IT professionals to exchange ideas and solve problems. The company was founded in 2007 and is generating revenue from their $3,000 annual memberships. Wisegate CEO told the Austin Business Journal that the company has “thousands of members”

Cowtown Angels were the lead investor in a $2.8 million dollar round with 23 participants. They previously raised $461,000 in 2011 and $900,000 in 2010.

TECH Fort Worth receives applications of companies who want to “pitch” to Cowtown Angels members at their monthly meetings, presents the qualified applicants to the Angels’ screening committee and helps companies selected by the screening committee prepare their presentations. Angel members decide individually whether they want to invest in a company.

“I see this investment as validation for our idea that there was a need for a local angel network,” said Darlene Ryan, Executive Director of TECH Fort Worth. “We believe that the Cowtown Angels program increases the amount of entrepreneurial activity here and helps the entire community.”

There are currently 20 members in the Cowtown Angel network.

Have you seen Dialexa, one of the coolest startups in Texas.

Top Resources For Understanding Startup Funding

It’s no secret that many activist investors are frustrated with the lack of financial literacy among entrepreneurs today. In my own battle against the blank face in the boardroom, I’ve been following the work of Brad Feld, Jason Mendelson, and Fred Wilson (in addition to asking some of our great investors questions directly).

It’s no secret that many activist investors are frustrated with the lack of financial literacy among entrepreneurs today. In my own battle against the blank face in the boardroom, I’ve been following the work of Brad Feld, Jason Mendelson, and Fred Wilson (in addition to asking some of our great investors questions directly).

Some of these online works can be a little overwhelming, however, with Fred Wilson’s MBA Mondays alone returning over 90 posts. Here are a few places to get started — followed by some additional resources I’ve found useful.

Brad’s professorial writing style explains the context around numerous accounting mechanisms and why they matter. Brad will get you thinking about the big picture before you dive into vocabulary.

Select Picks:

- Setting up your accounting system

- Balance sheet and cash flow overview

- Financial statements (examples, annotated)

- Revenue projections (and why to make them).

Jason Mendelson’s Convertible Debt Series

Convertible debt (and convertible equity) is popular for seed stage companies in Silicon Valley. Jason’s series will help you get comfortable with the levers behind most seed stage negotiations.

Select Picks:

- Conversion mechanics

- Conversion in a sale of the company

- Misc. terms

- Warrants

- Early vs. late stage dynamics.

Don’t forget to plan for success! Get familiar with what a term sheet looks like before you get one.

Select Picks:

Fred’s posts are among my favorite. Not only does he share concrete examples, he uses simple terms to get you familiar with almost every major financial metric that will have an impact on your business. I even printed Fred’s posts and annotated them rigorously until I understood how everything fit together.

Select Picks:

- Profit and loss statement

- Understanding the balance sheet

- Understanding cash flow

- Analyzing financial statements

- EBITDA.

Additional Resources:

- AskTheVC model documents and standard forms

- TechStarts open source documents

- Others blogging about term sheets.

This post originally appeared on the author’s blog.

Tyler Arnold is Co-Founder and CEO of SimplySocial Inc., a software tool that helps large companies create great content for their social media profiles. As CEO, Tyler assists with key accounts, business development, and talent acquisitions as SimplySocial grows its presence around the world.

The Young Entrepreneur Council (YEC) is an invite-only organization comprised of the world’s most promising young entrepreneurs. In partnership with Citi, the YEC recently launched #StartupLab, a free virtual mentorship program that helps millions of entrepreneurs start and grow businesses via live video chats, an expert content library and email lessons.

Now read 12 of the hardest questions venture capitalists will ask you

Google Ventures “We Will Never Invest In A Company That Tanks” Gets Fund Upped To $1.5B

Google’s venture arm, Google Ventures, is the proud recipient of $1.5 billion dollars in capital to invest in startups through 2017. Google Ventures has been the venture arm of the search and web giant since 2009. A mix of great entrepreneurs are involved with Google Ventures including Rich Miner one of the co-founders of Android and Kevin Rose (or is he).

Google’s venture arm, Google Ventures, is the proud recipient of $1.5 billion dollars in capital to invest in startups through 2017. Google Ventures has been the venture arm of the search and web giant since 2009. A mix of great entrepreneurs are involved with Google Ventures including Rich Miner one of the co-founders of Android and Kevin Rose (or is he).

While Google is known for their acquihires to bring talent from strategically related startups into the Google umbrella, Google Ventures is investing in startups for financial reasons and not necessarily for strategic partnerships. Some of their investments to date include HomeAway, Nest Labs and 23andMe.

The $1.5 billion dollar commitment is $100 million dollars more per year than Google Ventures has had in the past. Traditionally they’ve had $200 million a year to invest. That brings 2012 to $300 million, along with 2013 and the remaining years after that through 2014.

Google Ventures managing partner Bill Maris told the Wall Street Journal’s, Venture Capital Dispatch, that it took about 30 minutes to convince the powers that be at Google to up the ante. Maris is also very confident in the fund, telling the Journal “We will not invest in any company that tanks”

In addition to the investment Google Ventures now offers their portfolio companies a whole suite of services like design, marketing and technical recruiting. Of course all of these are resources that Google is very good at already.

The increase in funding was announced via a tweet last Thursday at a gathering in Mountain View of 100 Google Ventures portfolio companies.

Linkage:

Source: WSJ Venture Capital Dispatch

Make sure you come to this startup conference